capital gains tax increase 2021 retroactive

It appears that the White House is planning to make the. 01 October 2022 - 0400.

75 Of Stock Owners Won T Pay Biden S Proposed Capital Gains Tax Hike

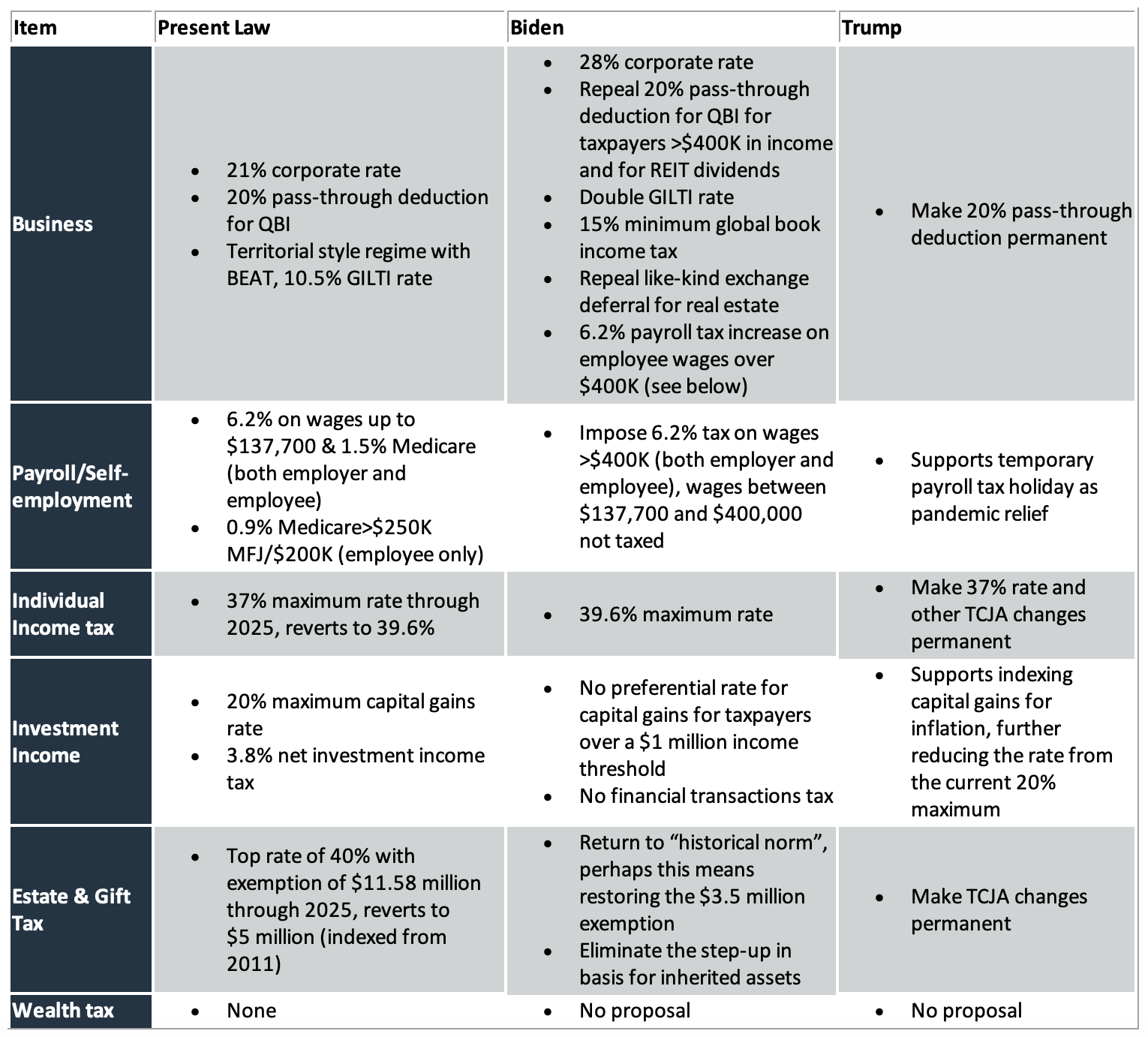

Lets remember that Congress must still approve any changes in tax rates as well as any retroactive effective dates.

. Will capital gains go up in 2021. Should the proposals become law. Biden unveiled a budget proposal Friday June 4 2021 that called for a 396 top capital gains tax rate to help pay for the American Families Plan.

Taxes and Asset Types -. The maximum capital gains are taxed would also increase from 20 to 25. My guess is that since the Democratic majority is so thin there is little chance any tax increase will be made retroactive to January 1 2021.

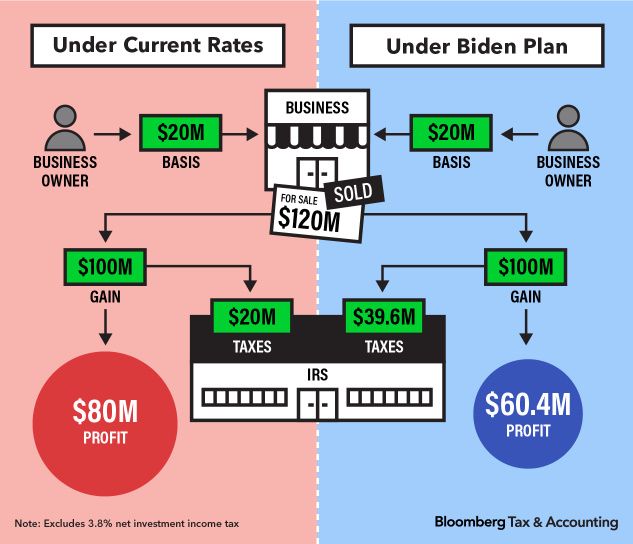

The increase in revenue would come from the higher tax brackets thus forcing high-income taxpayers to shoulder additional tax liability. Bidens Proposed Retroactive Capital Gains Tax Increase 2 weeks ago Jun 14 2021 Biden unveiled a budget proposal Friday June 4 2021 that. President Joe Biden is calling for a 396 top capital gains tax rate retroactive to the date of announcement.

Taxes and Asset Types - Investopedia 1 week ago Dec 21 2021 Capital gain is an increase in the value of a capital asset investment or real estate that gives it a higher worth. Proposed Biden Retroactive Capital Gains Tax Could Be Challenged on Constitutional Grounds. All may not be lost.

There are seven federal income tax rates in 2023. Retroactive Capital Gains Tax Hike On the tax front the biggest surprise in Bidens proposal is that he assumes an increase in the capital gains rate would be retroactive to April. Bidens Proposed Retroactive Capital Gains Tax Increase 2 weeks ago Jun 14 2021 Biden unveiled a budget.

It appears that the White House is planning to make the effective date. Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea. In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year.

The purpose of President Bidens. The 2022 Greenbook indicates that the proposed capital gains tax increase as part of the American Families Plan would be retroactive to late April 2021 the date of the Plans. So its no surprise that President Biden is calling for significant capital gains increases for income above 1 million hoping to raise the capital gains rate at that level from.

Heres how financial advisors are responding. The long term capital gain tax is graduated 0 on income up to 40000 15 over 40000 up to 441450 and 20 on income over 441451 in some cases add the 38. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need.

There is already some pushback among. AUGUST 11 2021 BYJOE BISHOP-HENCHMAN. Capital Gains Tax Rates 2021 To 2022.

A Retroactive Capital Gains Tax Increase. JD CPA PFS. Absent planning should all be taxed in 2021 the capital gains tax would be 3615000 500000 times 20 plus 9500000 times 37.

Treasury Secretary Janet Yellen suggested in remarks before a Senate panel that if Congress were to pass a capital-gains tax hike effective. This total tax is 2137200. Top earners may pay up to.

Many speculate that he will increase the rates of. The Wall Street Journal reports. The later in the year that a.

My guess is that since the Democratic majority is so thin there is little chance any tax increase will be made retroactive to January 1 2021. Or sold a home this past year you might be wondering how to avoid tax on capital gains. Capital gains tax is likely to rise to near 28 rather.

Ad If youre one of the millions of Americans who invested in stocks.

Advisers Blast Biden S Retroactive Capital Gains Proposal

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Capital Gains Tax Increase Proposals Under Biden Make Tax Planning Tougher Accounting Today

Understanding The Proposed Retroactive Capital Gains Tax Rate Increase Frazier Deeter Llc

Biden Hits The Campaign Trail With Tax Policy Proposals Wealth Management

Preparing For Tax Hikes Plan But Dont Panic Bny Mellon Wealth Management

Proposed Impactful Tax Law Changes And What You Can Do Now Johnson Pope Bokor Ruppel Burns Llp

Business Owners Speed Up Planned Sales Over Biden Tax Hike Fears

A Probable Capital Gains Tax Rate Increase And The Potential In Opportunity Zones Caliber

Tax Data Show Evidence Of Strong Income Gains For Higher Income Families And Only Muted Decreases For Lower And Moderate Income Families In 2020

Analyzing Biden S New American Families Plan Tax Proposal

Advisors Look For Ways To Offset Biden S Retroactive Capital Gains Tax Hike

Yellen Argues Capital Gains Increase From April 2021 Not Retroactive Bloomberg

Be Ready For Big Changes 2021 Tax Planning

Big Tax Changes Are Brewing What You Need To Know Barron S

2021 Tax Changes Biden S High Income Families Income Capital Gains Taxes Proposal

Accelerating 2021 Business Sales To Avoid Biden Tax Increase